USDT Market Cap Hits $160B: What It Means for Beginners, Investors & Experts

18 July 2025

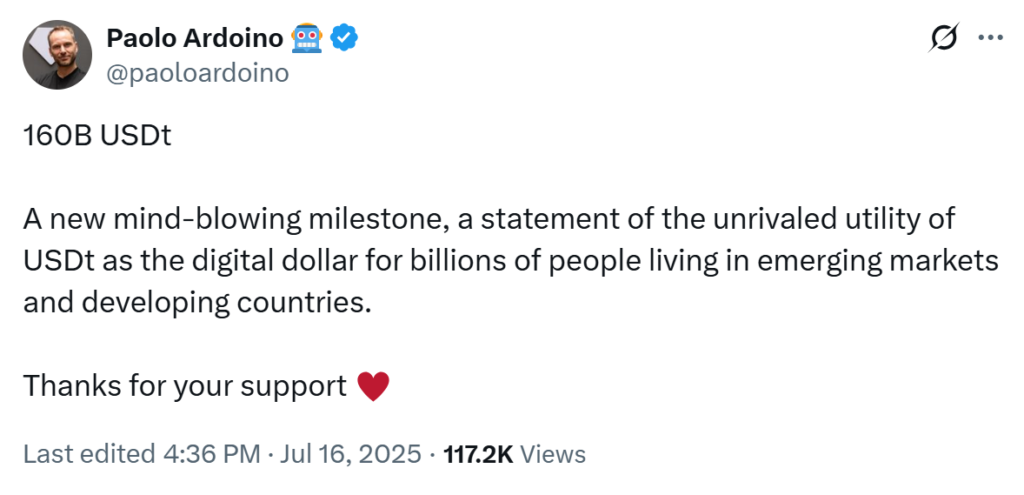

“160B USDt — a new mind-blowing milestone… a digital dollar for billions of people in emerging markets.”

— Paolo Ardoino, Tether CEO (via X)

On July 16, 2025, Paolo Ardoino, CEO of Tether, announced a milestone that marks a turning point not just for his company — but for the entire crypto economy.

USDT market cap has officially crossed $160 billion, a figure that cements its role as the leading Tether stablecoin in the global financial landscape. This isn’t just a number — it reflects rising trust in what many now call a “USDT digital dollar”.

But what does this really mean — for a new user? An investor? A blockchain professional?

Let’s break it down for everyone.

🔰 For Beginners: What Is USDT and Why Should You Care?

If you’re just stepping into crypto, you might be asking, “What is USDT?”

✅ USDT = A cryptocurrency pegged to the U.S. dollar.

1 USDT ≈ 1 USD (almost always)

That means, even though it’s a crypto token, its value doesn’t fluctuate wildly like Bitcoin or Ethereum. Instead, it’s stable, trusted, and backed by reserves (mostly in U.S. Treasury Bills).

🟢 Think of USDT as the digital version of the U.S. dollar, available 24/7, borderless, and without bank approvals.

You can:

Store it in your wallet as savings

Send money to family abroad in seconds

Trade it on exchanges safely

Use it on many websites that accept crypto

This is why over 400 million wallets are using USDT today. And that number is growing by nearly 35 million per quarter.

If you’re new to crypto and looking for a safe starting point, USDT for beginners is often the best entry.

📊 For Investors: Why USDT’s $160B Market Cap Matters

Crossing the USDT $160B milestone signals:

USDT is more liquid and trusted than ever

Stronger trading pairs (BTC/USDT, ETH/USDT, etc.)

A solid volatility hedge during market crashes

Easier on/off ramps for fiat in emerging markets

But here’s the strategic layer:

Tether is no longer just a crypto company — it’s becoming a digital central bank in places where traditional banking fails.

Countries like Turkey, Argentina, Nigeria, and India are seeing massive USDT adoption — as people hedge against inflation or send cross-border payments without high fees.

💡 As an investor, this shows real-world utility, not just hype. USDT use cases for investors are expanding fast.

This milestone strengthens Tether’s market cap as a metric to watch — both from an adoption and investment point of view.

🧐 For Professionals: What Signals Should You Be Watching?

If you’re already deep into crypto — a developer, analyst, or fund manager — this USDT milestone reflects deeper signals:

1. Tether as a Digital Central Bank

Tether now holds over $127B in U.S. Treasury assets, placing it ahead of many sovereign nations.

A geopolitical shift: a stablecoin firm holding more U.S. debt than governments.

This aligns with the narrative of Tether as digital central bank.

2. Dominance in Emerging Economies

Paolo’s tweet highlights the rise of USDT in emerging markets and developing nations.

This isn’t speculation — it’s grounded in data and use cases.

In many of these same regions, interest in de-dollarization is also rising. The recent emergence of BRICS Pay, a proposed payment infrastructure by BRICS countries, is one such initiative. It emphasizes how even institutional players are exploring alternatives to traditional U.S. dollar-based systems, with stablecoins like USDT bridging the gap.

3. Decentralized Dollar Demand

In countries facing currency devaluation, USDT utility in developing countries is soaring.

Demand for a reliable, dollar-pegged digital currency is growing.

Crypto professionals should see this as a strong validation of USDT adoption 2025 trends.

❤️ Human Impact: Beyond Charts and Tokens

Behind every $1 of USDT, there’s a story:

A Venezuelan teenager saving his earnings.

An Indian freelancer receiving USD payments.

A Turkish mother hedging inflation to buy food.

This is why Why USDT is important in crypto is no longer a theoretical question — it’s a human reality.

When Paolo Ardoino tweeted about the USDT $160B milestone, it was more than a celebration — it was a statement about how crypto is changing lives.

📌 Final Thoughts

Whether you’re:

Curious about crypto

Already investing in stablecoins

Or running DeFi protocols using USDT liquidity

The USDT market cap milestone is not just a headline — it’s a signal. A signal that crypto utility is growing.

And now you know how to use USDT for payments, savings, or investment — based on your level.

Next time you see USDT, don’t just see a token.

See a system.

A decentralized digital dollar built for the world.